What’s the Best Way to Increase Credit Score Fast: Top Strategies for Fast Improvement

What’s the Best Way to Increase Credit Score Fast? A high credit score is essential for financial stability and favorable credit terms. Whether you intend to apply for a mortgage, auto loan, or credit card, a high credit score can save you money over time. There are a number of strategies you can employ if you want to increase your credit score rapidly.

This article will discuss the quickest and most effective methods to improve your credit score, enabling you to reach your financial objectives.

I. Understanding Credit Scores:

A person’s credit score is a numerical representation of their creditworthiness as well as their financial history. Credit scores are used by lenders, banks, and other financial institutions to evaluate the level of risk associated with providing a borrower with a loan of money.

A lower credit risk is indicated by a better credit score, which makes it simpler for consumers to get loans, credit cards, and other financial products on favorable terms.

FICO (Fair Isaac Corporation) and VantageScore are the two credit scoring algorithms that are utilized by consumers the most frequently. The range of possible FICO scores is from 300 to 850, with higher scores suggesting a more favorable creditworthiness.

VantageScores, like FICO Scores, run from 300 to 850, however their scoring algorithm is a little bit different from that used by FICO.

The determination of credit scores is influenced by a number of factors, including the following:

- Payment History: The most important criterion that goes into determining credit scores is a person’s track record of making payments on time. It is beneficial to one’s credit score to have a history of on-time payment of bills and installments on loans.

- Utilization of Credit: Utilization of credit refers to the ratio of the amount of credit that has been used to the total amount of credit that is available. A lower percentage of available credit used is beneficial to a person’s credit score because it displays responsible credit management.

- Length of One’s Credit History The longer an individual’s credit history is, the more information there is to use in determining whether or not they are creditworthy. In most cases, having a longer credit history will result in a higher credit score.

- Credit Mix: It’s been shown that having a variety of credit accounts, like credit cards, loans, and mortgages, can have a favorable influence on a person’s credit score.

- New Credit Inquiries Making a new loan or credit card application can result in hard credit inquiries being added to a person’s credit report, which can temporarily cause credit scores to drop.

Individuals might benefit from knowing how their credit scores are determined in order to make more educated decisions regarding their finances and to improve their creditworthiness over time by taking the appropriate actions.

It is vital to do routine monitoring of credit scores as well as credit reports in order to identify inaccuracies or fraudulent actions and to ensure that credit profiles are accurate.

II. Check Your Credit Report:

Checking your credit report from the three main credit bureaus—Equifax, Experian, and TransUnion—is the first step in boosting your credit score quickly. AnnualCreditReport.com provides you with one complimentary credit report from each bureau every 12 months.

Examining your credit report enables you to identify any errors, inaccuracies, or fraudulent activities that may be lowering your credit score.

Examine personal information, account details, payment history, and credit utilization for inconsistencies. If you find errors on your credit report, you should dispute them with the appropriate credit bureau to have them corrected.

Eliminating incorrectly reported negative information from your credit report can increase your credit score.

Checking your credit report also helps you determine which factors have the greatest impact on your credit score. If you have missed payments, high credit card balances, or other negative elements, addressing these issues can result in substantial credit score improvements.

Monitoring your credit report on a regular basis ensures that you remain apprised of your credit health and take proactive measures to improve your credit score.

III. Pay Your Bills on Time:

Paying your payments on time is one of the most important factors for rapidly enhancing your credit score. Your payment history comprises a substantial portion of your credit score, and consistently making on-time payments demonstrates to creditors that you are responsible and dependable with credit.

Even a few days’ worth of delinquent payments can have a negative impact on your credit score. More recent and frequent late payments have a greater negative impact on credit scores. Therefore, it is imperative that you pay your obligations on or before the due date.

Set up reminders or automatic payments through your bank or credit card issuer to stay on top of your payments. Numerous financial institutions offer online bill payment services that enable you to schedule payments in advance, ensuring you never neglect a payment deadline.

If you have neglected payments in the past, you should attempt to catch up and remain current. Although late payments can remain on your credit report for as long as seven years, their impact on your credit score diminishes over time, particularly as you establish a pattern of on-time payments.

Consider paying more than the minimum payment, particularly on credit cards. Paying off your credit card balances in full each month can help you maintain a low credit utilization ratio, which is another important factor in boosting your credit score.

By paying your obligations on time every month, you demonstrate financial responsibility and positively affect your creditworthiness.

IV. Reduce Credit Card Balances:

Reducing your credit card balances is crucial for enhancing your credit score. Monthly payments should be greater than the minimum, with priority given to high-interest cards. Consider the alternative of the snowball method, which involves paying off lesser balances first.

A lower credit utilization ratio is indicative of responsible credit management and has a positive effect on your credit score. It may take some time, but consistently paying down credit card debt will result in substantial enhancements to your credit score and overall financial health.

Long-term credit score improvement requires avoiding the accumulation of new credit card debt and maintaining a disciplined payment strategy.

V. Avoid Opening Multiple New Credit Accounts:

The opening of multiple new credit accounts in a brief amount of time can have a negative effect on your credit score. Each new credit inquiry causes a minor, temporary drop in your credit score.

Having multiple new credit accounts may also indicate to creditors that you pose a greater credit risk, as it may indicate a need for additional credit or financial instability.

To avoid harming your credit score, exercise discretion when applying for new credit and establish new accounts only when necessary. Instead, focus on responsibly managing your existing credit and making on-time payments to increase your credit score incrementally over time.

VI. Become an Authorized User:

Becoming an authorized user on another person’s credit card could increase your credit score. When you are added as an authorized user, the positive account history of that credit card may be added to your credit report, which can have a positive effect on your credit score.

It is essential, however, that the primary account holder has a solid credit history and consistently makes payments on time. Being added to an account with a poor payment history could have the opposite effect and negatively affect your credit score.

Always communicate openly with the primary account holder, and use this method to enhance your credit score responsibly.

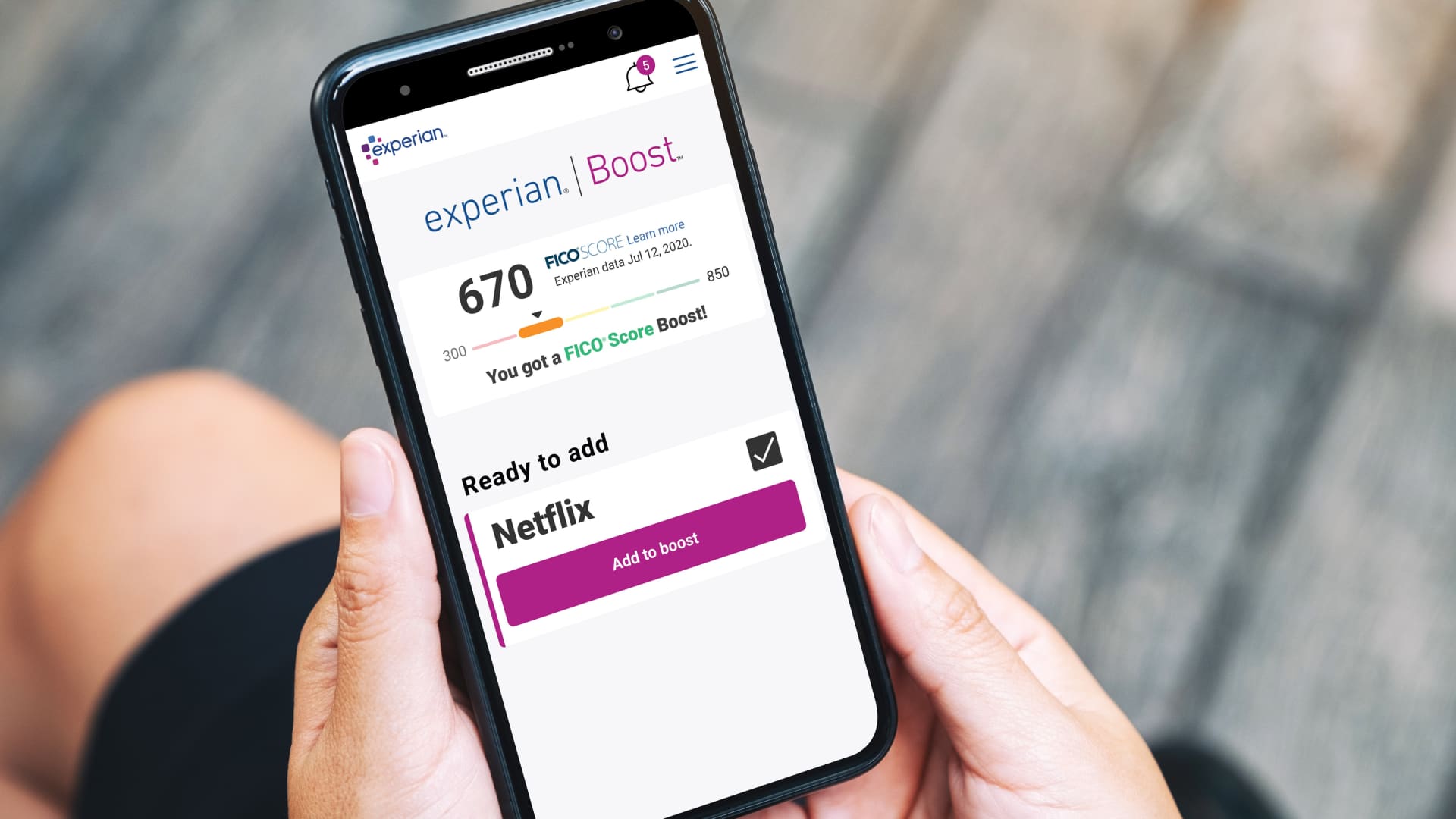

VII. Utilize Experian Boost or UltraFICO:

Experian Boost and UltraFICO are innovative credit-improvement instruments created by Experian and UltraFICO, respectively. Experian Boost enables the addition of positive payment histories from utility bills and other expenses to your credit report, potentially boosting your credit score.

UltraFICO, on the other hand, evaluates creditworthiness by considering your banking behavior, such as savings and checking account balances.

By utilizing these tools, you can improve your credit score and demonstrate fiscal responsibility. Before utilizing these tools, it is essential to comprehend the terms and conditions and assess whether they accord with your financial objectives.

VIII. Negotiate with Creditors:

Negotiating with creditors can be an effective method for enhancing one’s credit score. If you are experiencing financial difficulties and are unable to make payments, consider contacting your creditors to discuss potential alternatives.

You might be able to negotiate for lower interest rates, reduced payments, or even a settlement of your debt. A successful negotiation can result in a more manageable debt repayment plan, which can eventually have a positive effect on your credit score.

Be proactive, forthright about your circumstances, and willing to collaborate with your creditors to find a mutually beneficial resolution.

IX. Avoid Closing Old Accounts:

)

The impact of closing previous credit accounts on one’s credit score can be negative. The length of your credit history is a significant factor in determining your credit score, and older accounts indicate a lengthier credit history.

When you end an old account, the average age of your credit history decreases, potentially lowering your credit score. In addition, closing an account can reduce your available credit, which can increase your credit utilization ratio and impair your score further.

Consider keeping old accounts active and using them responsibly in order to maintain a positive credit history and increase your credit score.

X. Work with a Credit Counselor:

Working with a credit counselor can be a valuable option if you are unable to improve your credit score on your own. Credit counselors are trained professionals who can offer individualized guidance and advice on managing your finances and enhancing your credit score.

They can assist you in creating a budget, negotiating with creditors, and developing a repayment strategy. It is essential, however, to select a reputable and trustworthy credit counseling agency.

Consider credit-improvement organizations that are accredited and have a track record of success. Be wary of any company that promises fast fixes or requests large up-front payments.

XI. Be Patient and Persistent:

Improving your credit score is not a process that can be completed overnight and requires patience and perseverance. Your credit score may take some time to improve significantly, particularly if you have a history of late payments or high levels of debt.

The key is to adhere to the aforementioned strategies and consistently make responsible financial decisions. Monitor your progress by reviewing your credit report and score frequently.

Celebrate modest victories along the way, and keep in mind that each positive action will ultimately contribute to a stronger credit profile. With time and effort, you can improve your credit score and gain access to improved financial opportunities.

FAQ Related to What’s the best way to increase credit score fast?

How quickly can I see results from these strategies?

Answer: While individual results may vary, you can start to see improvements in your credit score within a few months of implementing these strategies. However, significant changes may take longer, depending on your unique financial situation.

Will my credit score increase instantly after paying off debts?

Answer: Paying off debts can positively impact your credit score, but it may not increase instantly.

Credit bureaus typically update credit reports once a month, so it may take a few weeks for the paid-off status to reflect on your report and influence your score.

Is it safe to utilize services like Experian Boost or UltraFICO?

Answer: Yes, services like Experian Boost and UltraFICO are safe and reputable. They use secure methods to access your financial information and report positive payment history, leading to potential score improvements.

However, always review the terms and conditions of such services before using them.

Can becoming an authorized user on someone else’s account hurt my credit score?

Answer: As an authorized user, you generally enjoy the benefit of their positive payment history, which can help your credit score. However, if the primary account holder misses payments or carries high balances, it could potentially have a negative impact on your score.

Will closing old accounts help or harm my credit score?

Answer: Closing old accounts can harm your credit score in some cases. The length of your credit history is a factor in credit scoring, so closing older accounts may shorten your credit history, potentially lowering your score.

It’s generally better to keep older accounts open and in good standing to maintain a positive credit history.

wait for 20 sec. for Jacqueline comic link

20

Conclusion:

It is important to keep in mind that there is no magic bullet that will instantly and significantly improve your credit score. In spite of this, you can make substantial headway in enhancing your creditworthiness and getting a higher credit score in the long term if you adhere to these techniques in a responsible manner and follow them consistently.

- Your Ultimate Guide to Travel Insurance for Adventure Sports

- A Guide to Renters Insurance for Pet Owners: Pet-Proof Your Policy

- Safeguard Your Future: Understanding Identity Theft Insurance

- Safeguard Your Event: Understanding Event Cancellation Insurance

- Everything You Need to Know About Critical Illness Insurance Riders

- Home Equity Loans vs. HELOCs: Which is Right for You?