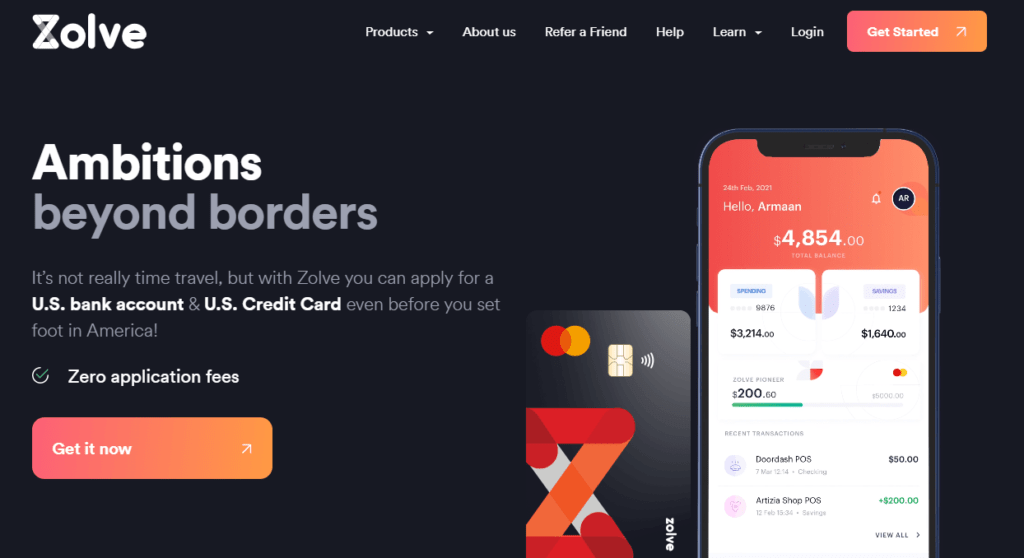

Zolve Credit Card: Everything You Need to Know

Zolve Credit Card is a financial product offered by Zolve, a fintech company that caters to individuals who are new to the United States from India. The credit card is designed to help these individuals build their credit scores and gain financial stability in the US.

With features like easy approval, no annual fee a rewards program, and no foreign transaction fees, the Zolve Credit Card is an attractive option for those who are starting their financial journey in the US. In this article, we will delve deeper into the benefits and eligibility criteria for the Zolve Credit Card.

Also, Read- Get the Best Deals and Rewards with Banter Credit Card – Apply Now!”

Benefits of Zolve Credit Card

Easy Approval: Zolve Credit Card is specially designed for people who do not have a credit history in the United States. Therefore, it is relatively easy to get approval for the card.

No Annual Fee: The Zolve Credit Card does not have an annual fee. This means that you can use the card without worrying about paying an extra fee every year.

Rewards Program: Zolve Credit Card offers rewards for every purchase you make using the card. You can earn up to 1.5% cash back on every purchase you make.

No Foreign Transaction Fees: The Zolve Credit Card does not charge any foreign transaction fees. This is an excellent benefit for people who frequently travel outside the United States.

Credit Building: Using the Zolve Credit Card responsibly can help you build your credit history in the United States. This can help you qualify for other credit products in the future.

Also, Read- Why Does Sports Betting Affect Credit Scores?

How to Apply for Zolve Credit Card?

To apply for the Zolve Credit Card, you need to meet the eligibility criteria, which are as follows:

- You must be 18 years or older.

- You must have a valid Social Security Number.

- You must have a valid Indian passport.

- You must have a valid US visa.

- You must have a US-based bank account.

Once you meet the eligibility criteria, you can apply for the Zolve Credit Card online by following these steps:

- Visit the Zolve website and navigate to the Credit Card section.

- Click on the “Apply Now” button.

- Fill out the online application form with your personal and financial details.

- Upload the required documents, including your passport, visa, and bank statements.

- Submit your application.

After submitting your application, the Zolve team will review it and verify your details. If everything is in order, you will receive an approval notification within a few days, and your Zolve Credit Card will be mailed to you. Once you receive the card, activate it by following the instructions provided, and start using it to build your credit history.

Conclusion

In conclusion, the Zolve Credit Card is an excellent option for individuals who have recently moved to the United States from India and are looking to build their credit history.

With no annual fee, a rewards program, no foreign transaction fees, and credit-building benefits, the Zolve Credit Card provides a range of financial benefits.

Applying for the card is easy and straightforward, and the eligibility criteria are not too stringent. If you meet the requirements, consider applying for the Zolve Credit Card to start building your credit score and gaining financial stability in the US.

- Home Equity Loans vs. HELOCs: Which is Right for You?

- Top Personal Loan Providers in the United States: Rates and Benefits Compared

- Student Loans in the UK: Best Options and How to Apply

- How to Qualify for a Home Loan in France: A Comprehensive Guide

- Understanding Insurance Deductibles: A Comprehensive Guide

- Insurance Strategy 101: How to Protect Your Assets and Minimize Risks