Sebi bars JM Financial from acting as lead manager of debt issue

[ad_1]

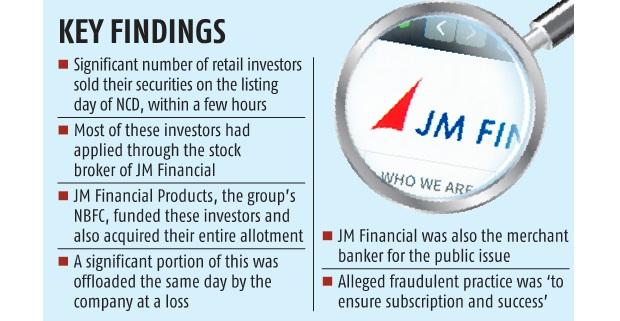

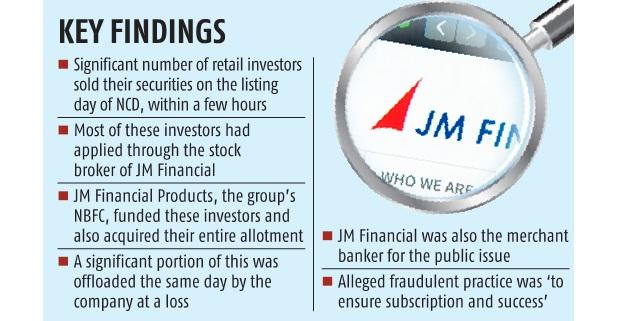

The Securities and Exchange Board of India (Sebi) on Thursday barred JM Financial from acting as the lead manager for any new public issue of debt securities due to alleged fraudulent practices.

In an ex-parte interim order, Sebi alleged that JM Financial incentivised certain investors to apply in the public issue and carried out transactions in a predetermined manner to ensure subscription and success.

Sebi’s action comes within days of the Reserve Bank of India (RBI) barring a company’s unit from extending loans against shares and bonds after an inspection revealed serious deficiencies in loans sanctioned for the financing of initial public offerings (IPO) and bond issuances.

RBI’s action was based on information shared by Sebi.

Shares of JM Financial tanked by 20 per cent following the RBI order on Wednesday. Later, the stock recouped the bulk of the losses.

Sebi observed that a significant number of investors in non-convertible debentures (NCDs) sold their securities allotted to them on the day of listing. This resulted in a sharp fall in retail holding and a rise in corporate holding.

Most of the retail investors who exited applied through the broker of JM Group.

These transactions were funded by JM Financial Products (JMFPL), a subsidiary of JM Group and a non-banking financial company (NBFC).

“JMFPL-NBFC not only funded these investors but acquired the entire allotment from the investors funded by them and subsequently offloaded a significant portion of the securities that it had acquired from these investors on the very same day at a loss,” said Sebi, in its 22-page order.

“The loss amount is significantly higher than the interest income earned by it…It does not make commercial sense for a company driven by profit motive to enter into transactions which resulted in consistent losses,” noted Sebi’s whole-time member Ashwani Bhatia.

For existing mandates given to JM Financial, Sebi has provided 60 days for continuing the services.

Sebi noted that JMFPL-NBFC was the seller, buyer, and then a re-seller (to corporates) of the NCDs of which JM Financial was the merchant banker.

The market regulator will complete the probe within six months where it will be looking into other public issues handled by the firm.

According to Refinitiv data, JM Financial was among the leading investment banks in 2023 for equity-related issuance. However, for the debt-related issuance, its name didn’t rank among the top 5.

Probe in inflating IPO subscription

The market watchdog is also examining the firm for a separate issue on inflated subscriptions in the IPOs of small and medium enterprises (SMEs).

“…it was observed that certain entities placed huge bids under the HNI category and subsequently also placed bids under the retail category This resulted in the issue being oversubscribed but the bids were rejected as multiple applications were made from the same PAN,” noted the interim order.

The bids in this case also originated from accounts held at the same Branch of ICICI Bank and PoA even in this case were executed in favour of entities forming part of JM Group.

Sebi has referred this matter to the RBI.

First Published: Mar 07 2024 | 9:12 PM IST

[ad_2]

Source link