Inside the record year for India’s $585 billion mutual funds industry

[ad_1]

By Ashutosh Joshi

A record surge in assets under management. More than 20 million new investment accounts added. And a planned return by BlackRock Inc., the world’s largest money manager.

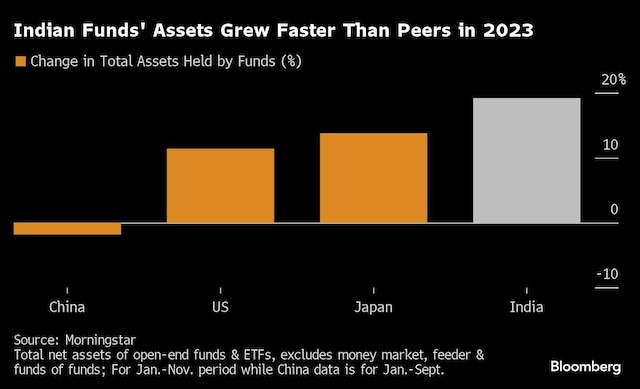

These are some of the milestones that mark what’s set to be a blockbuster year for India’s mutual funds industry. Powered by an insatiable thirst for financial gains, millions of young Indians armed with smartphones have taken to equity investments in the world’s most-populous nation. That’s helped boost fund assets by 19% in the first 11 months of 2023, data from Morningstar Inc. show, beating major peers like the US, Japan and China.

As the unforeseen gift of a pandemic-led boom in retail investing keeps on giving, and India’s $4.1 trillion equity market continues to grow — benchmark indexes are poised to cap a record eighth year of gains — industry veterans see mutual funds attracting a bigger slice of households’ financial assets in the years to come. Their share was under 9% as of March this year, versus about 45% for bank deposits.

“This year has been a turning point, a major qualitative shift,” said Dhirendra Kumar, New Delhi-based head of independent investment research firm Value Research Ltd., which has been advising mutual fund investors for three decades. “We have seen a democratization of investments in the sense that anyone who isn’t taking part feels like he or she is missing out.”

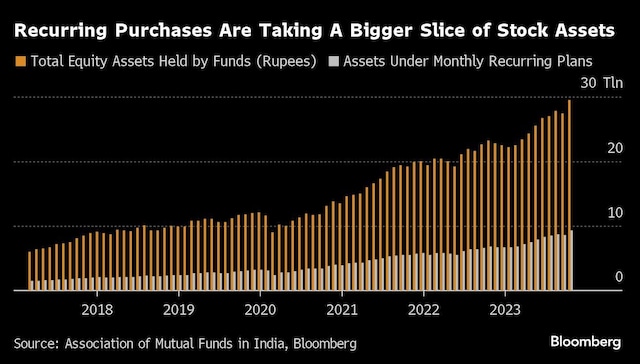

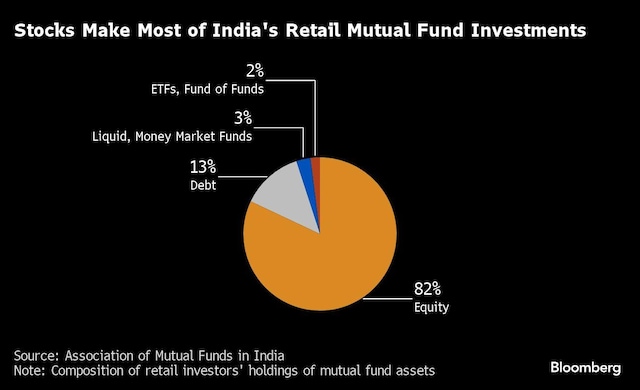

The upswing in assets has been led by equity funds. While rising financial literacy and improving incomes in India were already facilitating a move away from physical assets such as real estate and gold, and even bank deposits, the shift was turbocharged by the pandemic as Covid-driven curbs and job losses left millions of people at home with little to do. Stellar stock-market returns have also helped attract new investors.

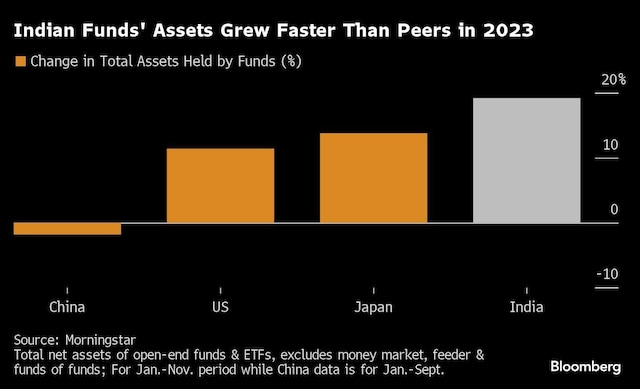

The result: local equity funds have seen inflows for 33 straight months through November, with monthly recurring plans emerging as the most popular product among retail investors. Flows via such plans have grown at a compounded annual growth rate of more than 25% since the onset of the pandemic, with November drawing a record $2.1 billion, according to Bloomberg Intelligence.

Money managed by Indian funds makes up about 16% of the size of the South Asian economy, with the proportion having doubled in the last 10 years, Amarjeet Singh, a whole-time member of the Securities and Exchange Board of India — the markets regulator — said at a conference in Mumbai last month.

Yet, there are only about 40 million unique mutual fund investors in the country of over 1.4 billion people, he noted, underscoring the scope for growth.

‘Coming of Age’

While the industry has seen periods of a spurt in retail purchases during previous bull markets, what’s notable this time is that the flows have been consistent and sticky.

“The mutual funds industry has come of age,” A Balasubramanian, MD and CEO of Aditya Birla Sun Life AMC Ltd., said in an interview in Mumbai earlier this month. “We are surprised by the sustainability of the flows.”

The steady stream of domestic money has also helped shield the market from the impact of foreign outflows, with equities rising in 2022 even as global funds withdrew a record $17 billion amid concerns over the Federal Reserve’s tightening. The flip side: continued stock gains mean that investors’ resolve hasn’t really been tested. It remains to be seen if their appetite for equity investments remains as voracious should a global or local shock send Indian markets into a tailspin.

“Fund inflows have become to the market what current- and savings-account deposits are for banks,” Vidya Bala, co-founder of Primeinvestor.in, an investment solutions platform for retail investors, said by phone. “Access to mutual funds has never been easier, thanks to technology. That has put individuals in control over when to enter or exit their investments. This wasn’t the case earlier” as procedures to buy/sell mutual funds were cumbersome, she added.

Meanwhile, not just fund houses but their stocks too are benefiting from this unprecedented growth. An equal-weighted index comprising shares of the four biggest listed asset managers in India has jumped almost 24% this year, exceeding the nearly 20% gain in the benchmark NSE Nifty 50 Index, data compiled by Bloomberg show.

As investors embrace equities, the share of debt products has been waning amid uncertainty surrounding interest rates and the removal of certain tax breaks.

Still, the industry’s average assets under management have jumped by 8 trillion rupees ($96 billion) in the first 11 months of 2023 to 48.75 trillion rupees, data from the Association of Mutual Funds in India, the industry body, show. The increase is set to be the biggest for any year on record.

‘Prosperity Ladder’

Promising growth prospects in what is still an under-penetrated market are luring new entrants. Fund houses sponsored by Zerodha Broking Ltd. and Nextbillion Technology Pvt., the firms behind the two biggest Indian brokerages, rolled out their first products this year.

Bajaj Finserv Mutual Fund and Helios Mutual Fund, which is backed by Singapore-based money manager Samir Arora, also debuted — taking the total number of fund houses in India to 44.

BlackRock too looks set to return to fund management in the nation after exiting in 2018. The firm in July agreed to form an equal joint venture with billionaire Mukesh Ambani’s financial services unit.

“For India to scale the prosperity ladder quickly, financialization of savings has to happen at a rapid pace,” said Vishal Jain, chief executive officer at Zerodha Fund House. There is a vast potential to increase retail participation if “simple, transparent and affordable products” are offered, he added.

First Published: Dec 28 2023 | 8:01 AM IST

[ad_2]

Source link