Health savings account answer book

Health Savings Account (HSA) Answer Book is a comprehensive guide to all aspects of HSAs, including eligibility requirements, contribution limits, tax implications, and other relevant information. The book is designed to help individuals, employers, and healthcare providers understand the benefits of HSAs and provide practical guidance on maximizing the use of these accounts.

The HSA Answer Book is written in a clear and concise manner, making it easy to understand for individuals with varying levels of knowledge about HSAs. It provides a wealth of information on how to set up and manage an HSA, how to make contributions, and how to use the funds to pay for medical expenses.

This book is a valuable resource for anyone looking to take advantage of the tax benefits of an HSA, including individuals who want to reduce their taxable income, employers who want to offer their employees an HSA option, and healthcare providers who want to advise their patients on the best way to pay for their medical expenses.

What is a Health Savings Account (HSA)?

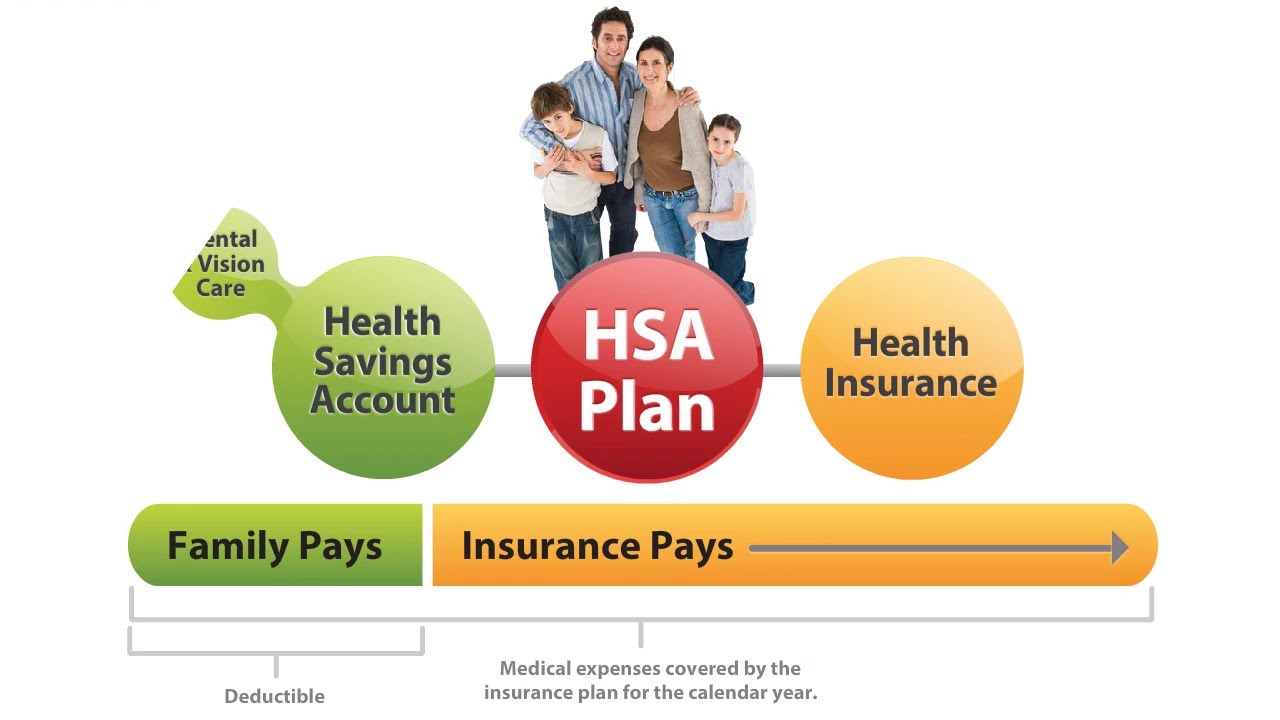

A Health Savings Account (HSA) is a type of savings account that individuals can use to pay for medical expenses. To be eligible for an HSA, individuals must be covered by a high-deductible health plan (HDHP). An HDHP is a health insurance plan that has a high deductible, meaning that individuals are responsible for paying a certain amount of their medical expenses before their insurance kicks in.

The funds in an HSA are tax-free and can be used to pay for various medical expenses, including doctor’s visits, prescription drugs, and medical supplies. In addition, individuals can use the funds in their HSA to pay for qualified long-term care insurance, COBRA premiums, and Medicare premiums.

Review of Health savings account answer book

The HSA Answer Book is a comprehensive resource that provides information on all aspects of Health Savings Accounts, including eligibility requirements, contribution limits, tax implications, and other relevant information. The book is designed to help individuals, employers, and healthcare providers understand the benefits of HSAs and provide practical guidance on how to maximize the use of these accounts.

The content of the book is organized in a clear and concise manner, making it easy to understand and use for individuals with varying levels of knowledge about HSAs. It provides a wealth of information on how to set up and manage an HSA, how to make contributions, and how to use the funds to pay for medical expenses.

Overall, the HSA Answer Book is a valuable tool for anyone looking to take advantage of the tax benefits of an HSA. It offers practical guidance on how to make the most of these accounts and provides the information needed to make informed decisions about their use.

It is an essential resource for individuals who want to reduce their taxable income, employers who want to offer their employees an HSA option, and healthcare providers who want to advise their patients on the best way to pay for their medical expenses.

Benefits of Health Savings Accounts

One of the primary benefits of an HSA is that the funds in the account are tax-free. This means that individuals can save money on their medical expenses and reduce their taxable income at the same time. In addition, the funds in an HSA roll over from year to year, so individuals can use the funds they have saved to pay for future medical expenses.

Another benefit of an HSA is that individuals have more control over their healthcare spending. Unlike traditional health insurance plans, which may limit the amount of coverage individuals can receive for certain treatments, individuals with an HSA can use their funds to pay for any medical expense that is considered eligible under the tax code.

Eligibility Requirements for Health Savings Accounts

To be eligible for an HSA, individuals must be covered by a high-deductible health plan (HDHP). For 2022, the minimum deductible for an HDHP is $1,400 for individuals and $2,800 for families. In addition, the maximum out-of-pocket expenses for an HDHP are $7,050 for individuals and $14,100 for families.

What is the interest rate for HSA?

The interest rate for a Health Savings Account (HSA) can vary depending on the financial institution holding the account. Typically, the interest rate for HSAs is comparable to that of a savings account, and it may be higher than the interest rates on checking accounts or other deposit accounts.

HSAs are typically offered by banks, credit unions, and other financial institutions, and the interest rates they offer may vary based on the institution’s policies and the current market conditions. Some financial institutions offer tiered interest rates, meaning the interest rate increases as the balance in the HSA account grows.

It is essential to research and compares different financial institutions and their interest rates when choosing an HSA provider to ensure that you receive the best possible rate for your account. However, it’s important to note that the primary purpose of an HSA is to save money for healthcare expenses, not necessarily to earn significant interest income.

Contribution Limits for Health Savings Accounts

For 2022, the contribution limit for an HSA is $3,650 for individuals and $7,300 for families. Individuals who are 55 years or older can contribute an additional $1,000 per year. Employers can also contribute to their employees’ HSAs, up to a specific limit.

Tax Implications of Health Savings Accounts

The funds in an HSA are tax-free, meaning that individuals can deduct their contributions from their taxable income. In addition, the funds in an HSA grow tax-free, and individuals can withdraw the funds tax-free as long as they use them for eligible medical expenses. If individuals withdraw the funds for non-medical expenses, they will be subject to income tax and a 20% penalty.

Conclusion

In conclusion, the Health Savings Account (HSA) Answer Book is an invaluable resource for individuals, employers, and healthcare providers seeking to understand the ins and outs of HSAs. The book covers a broad range of topics related to HSAs, including eligibility requirements, contribution limits, and tax implications, as well as the benefits of these accounts. The content is presented in a clear and concise manner, making it easy to understand and use.

The HSA Answer Book offers practical guidance on how to set up and manage an HSA, how to make contributions, and how to use the funds to pay for medical expenses. It also highlights the advantages of HSAs, such as tax-free contributions, rollover funds, and more control over healthcare spending.

Overall, the HSA Answer Book is an essential tool for anyone looking to take advantage of the tax benefits of an HSA, and it provides the information needed to make informed decisions about these accounts. Whether you’re an individual looking to reduce your taxable income or an employer seeking to offer your employees an HSA option, this book will help you navigate the complexities of HSAs and make the most of their benefits.