Africa’s biggest insurer Sanlam banks on India as its home market reels

[ad_1]

By John Viljoen

Sanlam Ltd., Africa’s biggest insurer, is banking on India to boost profit in the short term and tide over tepid economic growth at home in South Africa.

The Cape Town-based firm has the potential to triple the proportion of profit it derives from India within a decade, Chief Executive Officer Paul Hanratty said. Sanlam has partnered with the Shriram Capital Group in the South Asian nation since 2005 and that country now makes up about 10% of profit.

“If you ask where our real short-term upside is, it’s India,” Hanratty, 62, said in an interview. “We’ve got a great business with them, growing tremendously. That is our fast-growth outlet.”

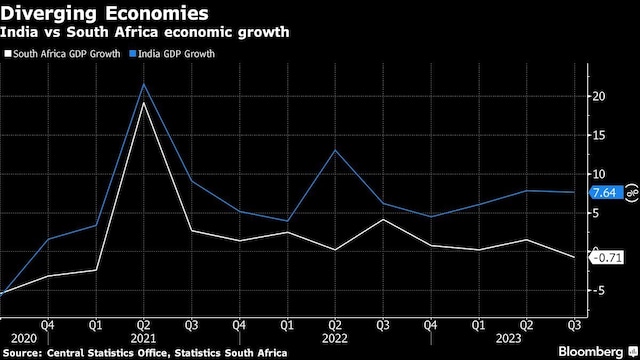

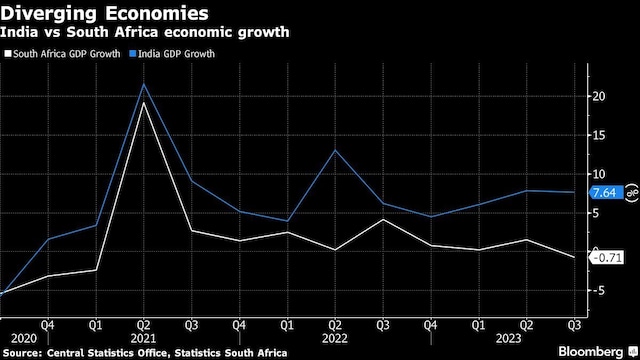

India’s $3.4 trillion economy is expanding almost five times quicker than Sanlam’s home market, with the World Bank forecasting 6.4% growth this year. That’s helped more than double the number of Indians earning over $10,000 annually to 60 million in the past nine years, luring firms such as Sanlam and BlackRock Inc. to set up local ventures.

The partnership with Shriram, which operates a listed financing business and two insurance firms, gives it a foothold in a country with a population that exceeds Africa’s.

Sanlam’s shares have climbed 33% over the past 12 months, the biggest gain in the Johannesburg stock exchange’s gauge of four life assurance companies. The bourse’s benchmark index has dropped almost 8% in the period.

Founded 106 years ago, the business is backed by South African billionaire Patrice Motsepe, who is vice chairman. His Ubuntu-Botho Investments vehicle controls the insurer’s second-biggest shareholder, with a stake of about 11%, according to data compiled by Bloomberg.

Sanlam depends on South Africa for about 75% of its revenue, but power shortages that have led to rotational blackouts are driving up costs and hobbling the economy. Supply chains are snarled by a dysfunctional ports system and rail network bottlenecks, causing delays for both exporters and companies shipping in components.

“Sanlam cannot thrive in the long run without a thriving South Africa,” Hanratty said. “Ultimately, we need the country to do well.”

Outside India, the CEO sees potential in some other African markets. There are about 10 countries on the continent that “move the dial for Sanlam,” and the insurer lacks the scale it should have in some of these, Hanratty said.

The company will eventually require acquisitions to grow in East Africa, which is attractive because of its relatively well functioning democracies, consistent weather patterns, good demographics and important links with Asia, he said.

In Nigeria — Africa’s most-populated nation — Sanlam may expand organically in general insurance, Hanratty said. Sanlam has an eight year-old presence in Morocco through its investment in Saham Finances SA, while a joint venture with Allianz SE formed in 2022 has operations in 27 African countries.

“We’ve got good businesses in Africa and I do think that Africa will continue to do relatively well, and rising income levels help our business,” he said.

First Published: Jan 17 2024 | 3:59 PM IST

[ad_2]

Source link