Maximize Your Savings in Utah with Top High-Yield Savings Accounts

A high-yield savings account is a type of savings account that typically offers a higher interest rate than a traditional savings account. This can make it an attractive option for those looking to earn more interest on their savings while still keeping their money accessible.

In Utah, there are several options for high-yield savings accounts offered by both online banks and traditional financial institutions.

These accounts can have varying interest rates, fees, and account requirements, so it’s important to do your research and compare options to find the best fit for your financial goals.

In this article, we will explore the benefits and features of high-yield savings accounts in Utah and provide recommendations for some of the top options available.

Also Read – Kosher on a Budget: How to Live Fruitfully Without Multiplying Your Budget

The Best Savings Accounts in Utah

If you’re looking to save money in Utah, a savings account can be a great option. Savings accounts are a safe and easy way to set aside money for a rainy day, a big purchase, or a long-term goal. In this article, we’ll explore some of the best savings accounts available in Utah.

Ally Bank Online Savings Account

Ally Bank is an online bank that offers a high-yield savings account with a competitive APY of up to 0.50%. There are no monthly maintenance fees or minimum balance requirements, and you can access your account online or through the Ally mobile app. Ally Bank is FDIC-insured, which means that your deposits are protected up to the maximum allowed by law.

Capital One 360 Savings Account

Capital One 360 is an online bank that offers a savings account with a competitive APY of up to 0.40%. There are no monthly maintenance fees or minimum balance requirements, and you can manage your account online or through the Capital One mobile app. Capital One 360 is also FDIC-insured, which means that your deposits are protected up to the maximum allowed by law.

Goldenwest Credit Union Regular Savings Account

Goldenwest Credit Union is a local credit union that offers a regular savings account with an APY of up to 0.10%. There are no monthly maintenance fees or minimum balance requirements, and you can access your account online or through the Goldenwest mobile app. Goldenwest Credit Union is also federally insured by the National Credit Union Administration (NCUA), which means that your deposits are protected up to the maximum allowed by law.

Discover Bank Online Savings Account

Discover Bank is an online bank that offers a savings account with a competitive APY of up to 0.40%. There are no monthly maintenance fees or minimum balance requirements, and you can manage your account online or through the Discover mobile app. Discover Bank is also FDIC-insured, which means that your deposits are protected up to the maximum allowed by law.

Alliant Credit Union High-Rate Savings Account

Alliant Credit Union is a nationwide credit union that offers a high-rate savings account with a competitive APY of up to 0.55%.

There are no monthly maintenance fees or minimum balance requirements, and you can access your account online or through the Alliant mobile app. Alliant Credit Union is also federally insured by the NCUA, which means that your deposits are protected up to the maximum allowed by law.

Also, Read- Health savings account answer book

Bank has the highest high-yield savings

The bank with the highest high-yield savings account can change over time and can depend on various factors such as current interest rates, fees, and account requirements. However, as of February 2023, some of the banks with the highest high-yield savings account APYs include:

- Vio Bank: 0.66% APY

- Axos Bank: 0.61% APY

- Citi: 0.60% APY

- Comenity Direct: 0.60% APY

- TIAA Bank: 0.55% APY

It’s important to note that the interest rates on high-yield savings accounts can change frequently, so it’s a good idea to regularly check for updated rates.

Additionally, it’s important to consider other factors when choosing a high-yield savings account, such as account fees, minimum balance requirements, and other features that may be important to you.

Conclusion

In conclusion, a high-yield savings account can be a great option for those looking to earn more interest on their savings in Utah. These accounts typically offer higher interest rates than traditional savings accounts, while still allowing easy access to funds.

While there are many options available, it’s important to compare features such as interest rates, fees, and account requirements to find the best fit for your financial goals.

Some of the top high-yield savings account options in Utah include Ally Bank, Capital One 360, Goldenwest Credit Union, Discover Bank, and Alliant Credit Union. With careful consideration and research, you can choose the account that works best for you and start saving with confidence.

- Empowering Communities: The Colorado Healing Fund Club Q Partnership

- How to Avoid Property Tax Reassessment California Prop 19? | How to Avoid Property Tax Reassessment California Prop 13

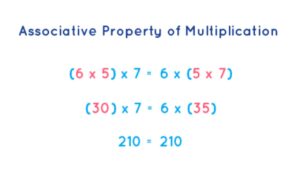

- What is the Associative Property of Multiplication?

- What is a Leasehold Property in USA?

- When are Property Taxes Due in California in 2023?

- Is Recreational Products/Toys A Good Career Path in 2023