How Can I Buy Index Funds Without A Demat Account?

There has been a steady rise in the use of index funds in recent years. According to the Association of Mutual Funds in India (AMFI), index funds’ assets under management (AUM) totaled Rs 1.73 lakh crore in FY21-22, up 197% from Rs 58,173 crore in FY20-21.

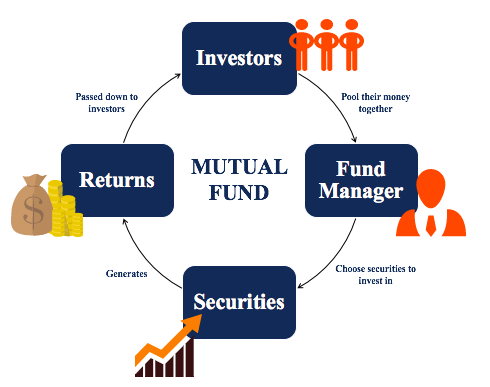

The confusion between index funds and equities persists despite the growing popularity of and demand for index funds. Like mutual funds, index funds invest in stocks based on the composition of an index. Investing in index funds, however, does not necessitate a Demat account like buying equities does.

Putting money into an index fund is similar to putting money into any other mutual fund. In addition, recent developments in technology have made it possible to invest in mutual funds from the comfort of one’s own home via a variety of online platforms.

Learn how to invest in index funds or mutual funds without a Demat account.

The Easiest Way to Buy Index Funds

Investing in mutual funds can be done through either a direct plan or a regular plan. First, let’s distinguish between direct and regular plans.

Due to the lack of commission and distribution costs, the expenditure ratio for direct plans is generally lower. In contrast, the mutual fund company will pay a commission if you purchase a normal plan through an intermediary like a distributor. Accordingly, the expenditure ratio for regular plans is larger than that of direct plans.

You can shop for index funds either online or in a physical brokerage, depending on your preferences and your investment strategy.

Here are a few choices to consider.

Making a Purchase Via the AMC Website or Office

Investors can access the products of most mutual fund providers online or via mobile app. When you visit the AMC office, you can also invest offline.

When investing in mutual funds, it’s important to remember that investing in funds managed by a single AMC eliminates the possibility of diversification. If possible, spread your money out among several different fund companies. It can be time-consuming to research and visit various fund houses in order to make an investment.

Separate Access Points

You can purchase shares of multiple mutual funds through a number of separate websites. First, you’ll need to sign up and create an account. In addition, these platforms can finalise your KYC processes. In the online market, buying and selling currency is as simple as creating an account. Such hubs also have an online portfolio tracking platform.

Salespeople for Mutual Funds

Several mutual funds are available for investment through a wide variety of offline distributors. Distributors can travel to your house to discuss investment opportunities with you. These experts advise clients on how to best take advantage of market fluctuations and new investment strategies.

However, there are several drawbacks to utilising mutual fund agents, such as greater fees, conflicts of interest, fewer investment choices, and a lack of transparency.

Banks

Financial institutions are a common source for index mutual fund investments. Even financial institutions like banks can act as mutual fund agents. Find out if the bank you’re thinking about doing business with sells the mutual fund you’re considering by asking about it. Investors should be wary of “mis-sellers,” or those who falsely recommend a certain investment fund in order to increase their own compensation. When you have settled on a particular mutual fund, this is the way to go.

Benefits of Using MF

Index mutual funds can also be purchased via the MF Utility trading platform. The platform facilitates a wide range of mutual fund transactions, such as purchases, redemptions, and switches. It eliminates the need to open multiple accounts with different AMCs by facilitating transactions involving mutual funds from multiple AMCs on a single platform.

One thing to keep in mind is that the MF Utility platform is self-service, so you won’t get any individualised help with your investments.

Money Management App from ET

Index funds can be purchased through electronic mediums like the ET Money app. The app’s many advantages include its user-friendliness and flexibility, thoroughness of financial planning, variety of investment opportunities, tax savings, and individualised recommendations.

All mutual fund schemes are accessible through the ET Money app. Direct mutual funds from leading asset management companies (AMCs) allow you to invest with no fees and keep tabs on your portfolio value.

You can evaluate the returns, consistency, expense ratio, and other aspects of a mutual fund scheme, as well as rival schemes in the same category through the ET Money app. You can learn more by clicking here.

Bottomline

You could look for a method of investing in index funds that works better for you. You should know that there are restrictions on some of these choices. For instance, while AMCs make it possible to invest directly in funds, you’ll need to create and remember a unique ID and password for each AMC.

One possible improvement would be using a web-based service, like the ET Money app.

- Your Ultimate Guide to Travel Insurance for Adventure Sports

- A Guide to Renters Insurance for Pet Owners: Pet-Proof Your Policy

- Safeguard Your Future: Understanding Identity Theft Insurance

- Safeguard Your Event: Understanding Event Cancellation Insurance

- Everything You Need to Know About Critical Illness Insurance Riders

- Home Equity Loans vs. HELOCs: Which is Right for You?

One Comment